With the return of Maji Da Ge and Yi Nengjing, is the NFT market really going to recover this time?

“Machi led the way, then Annie Yi followed. We’re seeing the return of many major NFT whales from the last cycle.”

In 2021, celebrities set off a massive NFT boom. Now, they’re making a comeback, bringing new stories and placing fresh bets on the market.

At the same time, NFT trading volumes are rising again and buyers are surging. But is this apparent revival a sign of an oncoming spring—or just a mirage in the lingering cold of crypto winter?

Is the NFT Market Undergoing a Major Transition?

Macro indicators for the market present a puzzling set of contradictions.

Long-term prospects remain bullish: Reputable firms like Vancelian project that the NFT market could soar into the tens of billions of dollars this year. Yet in the short term, reality is far less rosy—DappRadar’s report shows NFT trading volume dropped nearly 29% quarter-over-quarter in Q2.

But this apparent downturn hasn’t triggered panic. Instead, it’s revealing an underlying shift in market structure.

DappRadar data shows that in Q2 2025, total NFT trading volume fell as high-value collectibles declined, but transaction count skyrocketed 78% from about 7.02 million to 12.5 million, and the number of unique buyers jumped 44% from 651,000 to 936,000.

This counterintuitive trend—lower prices, higher volumes—signals a deep transformation. NFTs are quietly moving away from being a high-stakes game for a select few toward widespread mainstream adoption.

Coindoo highlights that while aggregate volumes have declined, both the growth in transaction count and the drop in average deal size show that the market is broadening. The driving force is shifting from pure speculation to real utility and stronger community consensus.

And at this pivotal moment, “celebrity whales” who previously left the space are returning. What does their comeback really mean?

Celebrities Are Back—But Is the “Scythe” Still Sharp?

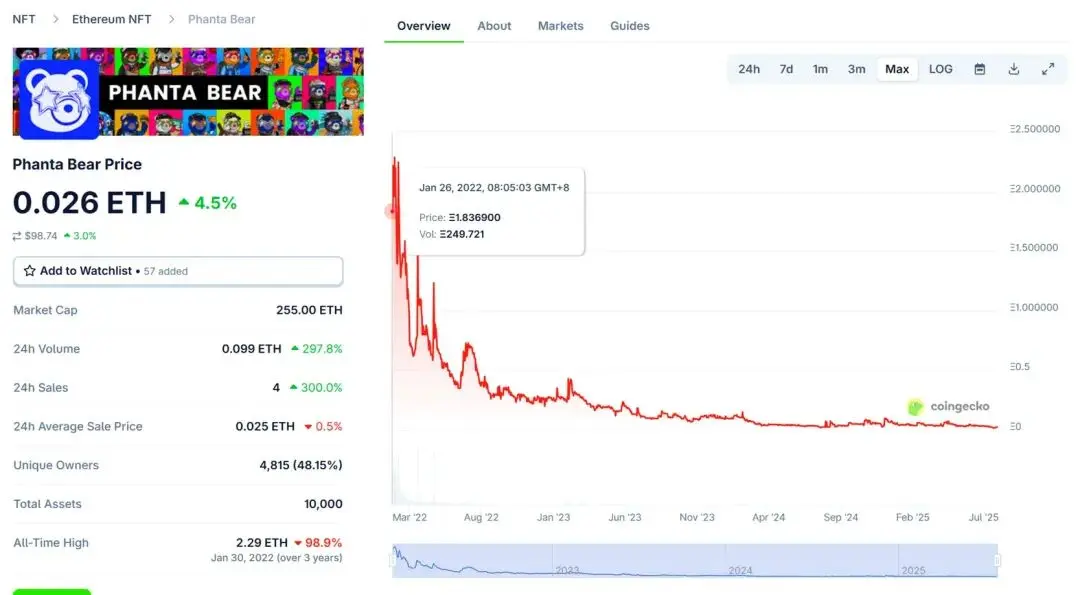

From Jay Chou’s PhantaBear and Shawn Yue’s ZombieClub to Annie Yi’s Theirsverse, these once-hyped projects have seen floor prices drop more than 98% from their peaks—practically to zero. Behind those harsh numbers are countless silent investors still licking their wounds.

Source: CoinGecko, Cryptorank

To understand the market today, you have to look back at those years when euphoria and realism were intertwined.

2021: The Height of Hype

This was a golden era, when visionaries and speculators danced side by side.

Bitcoin surged to its all-time high of $69,000. NFTs vaulted from niche collectibles to global headlines. In October 2021, Machi Big Brother famously spent 425 ETH on a Cyborg Bored Ape, setting off a wave of FOMO.

By year-end, Jay Chou’s PhantaBear sold out in 40 minutes, pulling in over $10 million in sales in a single day.

2022: The Crypto Winter

The boom faded in a flash. Black swan events, spiking inflation, rate hikes, and war all hit the market. Bitcoin plunged below $20,000, and total crypto market cap was slashed in half to $1 trillion.

Edison Chen, Shawn Yue, and Annie Yi all launched NFT projects, but each one eventually foundered amid the bear market. Theirsverse crashed from 0.219 ETH to 0.02 ETH—a 96% drop—and Annie Yi was dubbed the “Queen of Retail Bagholders.”

2025: Old Faces Return, New Power Players Arrive

Today, Machi Big Brother has reinvented himself—shifting from NFT whale to one of the top high-leverage meme coin traders. He’s throwing real capital at tokens like BLAST and PUMP, openly sharing profits and losses, and has cemented his status as the market’s most fearless gambler. Annie Yi, too, has quietly reentered the scene.

In addition, legendary entrepreneur Qian Fenglai stormed into Web3 at the start of the year, boasting a nine-figure fortune and pledging $100 million to build a “Peach Blossom Land NFT.” Galaxy Digital’s Mike Novogratz, meanwhile, has quietly swapped his PFP to a Pudgy Penguin.

It feels like 2021 all over again—celebrities are back, markets are buzzing. But this time, there’s less blind faith and a lot more caution under the surface.

Community Evolution: From Followers to Value Arbiters

In 2025, the NFT community isn’t just participating—it’s become the true arbiter of value.

On the surface, metrics look strong: NFT transaction volumes are steadily rebounding, and blue-chip collections like CryptoPunks, BAYC, and Pudgy Penguins keep climbing. Yet this time, the community’s reaction is cooler and more rational than ever before.

“The 2021 NFT mania is gone for good,” @RicecakeNFT declared bluntly on X. “The bar to entry is much higher now, and investors care more about real utility and community value.” That’s the bottom line for NFTs in 2025: as speculative fever fades, the focus is shifting firmly back to real value.

Community member @waleswoosh predicts: “In 2025, a single dominant NFT project might disappear entirely, but we’ll see several with floor prices above 50 ETH—this will be a year of repricing and real value.”

The NFT world in 2025 looks lively on the outside but is now fundamentally more rational and mature.

From speculation to consensus, from hype to logic, this deep transformation is resetting how value is defined in the NFT market.

Disclaimer:

- This article is republished from [TechFlow], with copyrights retained by the original author [Zz, ChainCatcher]. If you have concerns about this republication, please contact the Gate Learn Team; our team will handle it promptly according to standard procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn Team. Unless explicitly referencing Gate, translated content may not be copied, distributed, or plagiarized.