XRP Price Prediction: Pulls Back in the Short Term as Institutions Defend Key Support, Targeting $4 - $5 Rebound

XRP Market Overview

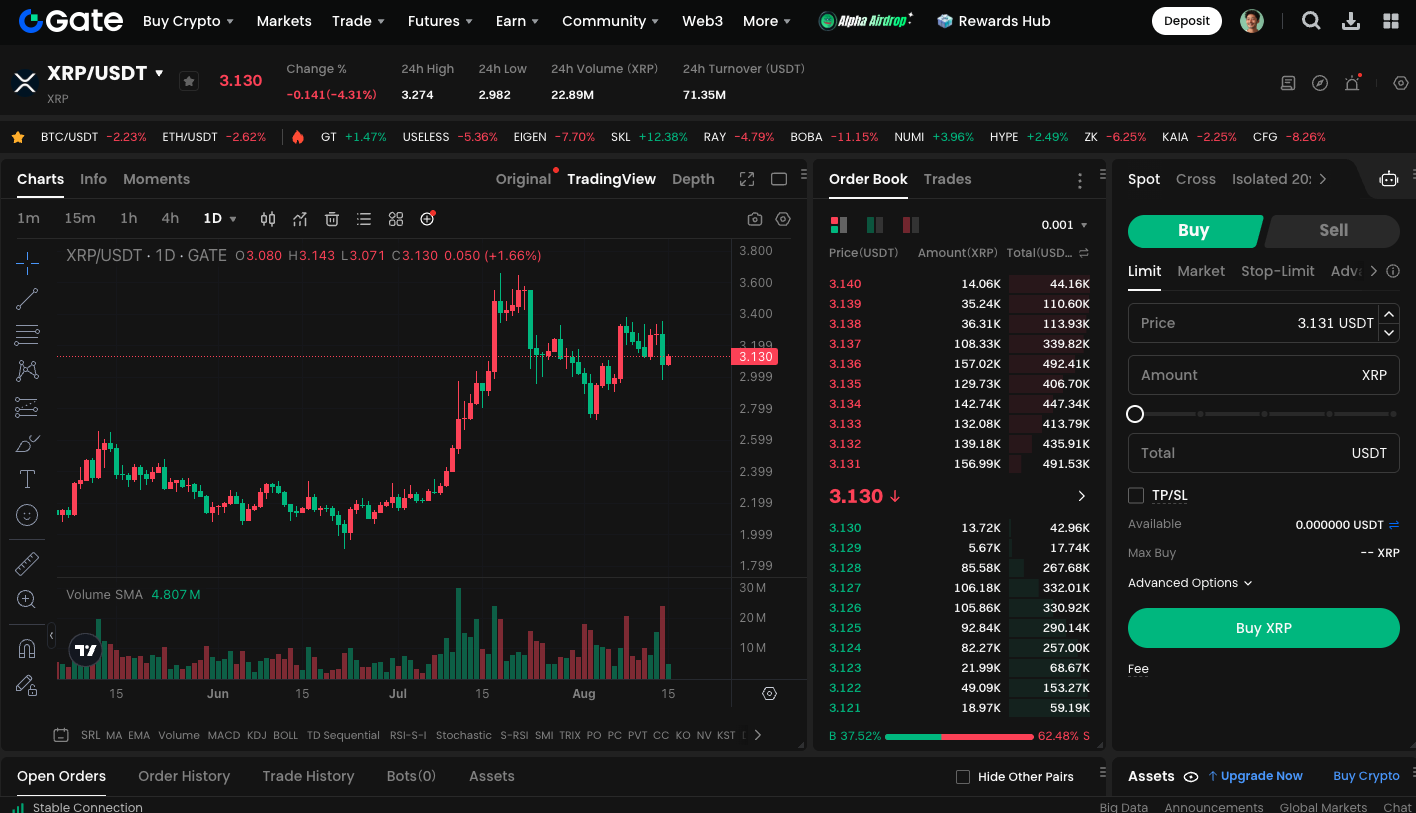

In recent market swings, XRP has declined by approximately 5.37% from its peak and is now trading at $3.13, currently testing a major support level. This pullback coincided with a rapid $1 billion liquidation in the crypto market, reflecting institutional profit-taking at elevated prices.

Key Support and Resistance Levels

Technically, XRP’s current low is near $3, which serves as both psychological and technical support. If this level holds, the price could rebound toward the 20-day moving average and challenge resistance at $3.35, $3.4, and ultimately $3.5. The 50-day moving average at $2.9 represents secondary support; a breach here could increase the likelihood of a drop toward the $2.7 - $2.4 range.

Institutional Positioning and Fundamental Tailwinds

Ripple CTO David Schwartz recently announced that the XRP Ledger is now fully capable of supporting global financial infrastructure. He added that it will help drive the future of cross-border payments and asset settlement. In addition, with regulatory clarity following the end of the SEC lawsuit, conditions are set for deeper institutional involvement. Ripple CEO Brad Garlinghouse also indicated that RLUSD, the stablecoin, could enter the global top five by the end of the year, which would further boost the XRP ecosystem’s utility.

Market Momentum and Trading Data

Despite the price pullback, open interest on XRP futures has climbed back above $3 billion, showing renewed trading enthusiasm. Daily trading volume has surged to nearly $11.9 billion, accounting for 6.5% of market cap, pointing to active position adjustments by institutional players. The RSI remains neutral, and while the MACD line is slightly bearish, the histogram is still positive, hinting at a potential rebound in the near term.

Potential Scenarios

- Support Holds and Price Rebounds

If the $3 - $2.9 support range is defended and fundamentals continue to strengthen, XRP could reach the $4 to $5 mark in the next 90 days. - Range-Bound Consolidation

The price may oscillate between $2.8 and $3.3, providing accumulation opportunities for institutions and long-term investors. - Further Correction

If support at $2.9 fails, accelerated selling could drive prices down to the $2.7 - $2.4 region.

Start trading XRP spot: https://www.gate.com/trade/XRP_USDT

Summary

XRP is now at a critical inflection point, where key technical levels and positive fundamentals converge. If support is maintained, ongoing institutional accumulation and ecosystem development could push prices back into bullish territory, with a short-term target of $4 and potential to test $5. Should support break, however, a significant correction may occur, opening strategic entry points for long-term investors. *

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025